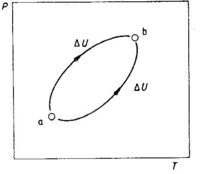

In engineering there are state functions and path functions. State functions mean that the current state is independent of the path to get there. Path functions are dependent on the path. I would like to talk about state functions … in the context of finance. Bear with me for a minute.

Sometimes the state that you are in right now doesn’t matter much on how you got there. What does that mean? Here are several examples … In 2002 you traveled in a taxi instead of a limo to your house from the airport; in 2004 you ate at a buffet instead of a sit-down restaurant for dinner; in 2005 you checked out a book from the library and didn’t buy it from a bookstore. The person you are now wasn’t affected by those actions. In 2002 you got home, in 2004 you were nourished, in 2005 you were inspired by the author.

But …

In 2002 you could have invested the difference of $40 between the taxi and limo. And in 2004 you could invest the $30 for the difference between the buffet and restaurant. Or in 2005 you could invest the difference of $30 for the book. All those savings could be compounded by time. The sum of these differences could add to significant amounts for your current life. It could be thousands of dollars. It could be tens of thousands of dollars. Or even hundreds of thousands of dollars.

Your current life isn’t affected much by perturbations in state functions. In fact, your current state isn’t affected at all by them. AT ALL.

On the other hand, your finances are HIGHLY dependent on the incremental costs incurred as you travel along the lifepath to reach your current state. Those incremental costs compound over time.

You will come out ahead if you minimize expenses for state functions in your life.

Can you identify the state functions in your life? The Independent Penguin can.